Liberalising the European rail passenger market - the British experience

Professor Chris Nash and Dr Andrew Smith take a look at how Britain has coped with rail passenger liberalisation, what has happened to rail demand and costs.

In the article, first published in European Rail Review, they also look at what possible solutions there might be to the problems experienced.

Since 2007, the European rail freight market has been completely open to new entry, and according to the most recent EC Rail Market Monitoring report, by 2012 considerable new entry had occurred. In 11 countries entrants held 20% or more of the market, although the EVES-rail study in which we participated could find no evidence of an impact of new entry on either costs or rail market share. By contrast, liberalisation of the passenger market was only required for international services, and only a handful of countries had gone further. In Britain, all passenger services had been taken over by new entrants, almost entirely through competitive tendering for franchises for profitable as well as unprofitable routes, with a very small number of services run commercially by open access operators. Elsewhere in Europe, by 2012 only in Sweden and Germany had new entrants gained more than 15% of the suburban and regional market; there was significant open access operation in the Czech Republic, Italy and Austria, but the biggest share of the long-distance market taken by new entrants was 7%.

Thus the experience of Britain is of particular importance, and at the Institute for Transport Studies (ITS) we have studied this extensively; a review of our work with references can be found in: Andrew S.J. Smith and Christopher Nash (2014) Rail Efficiency: Cost Research and Its Implications for Policy. Discussion Paper No 2014-22, International Transport Forum. In the next section we discuss the form that liberalisation in Britain took. We then look in turn at what has happened to rail demand and costs, and discuss possible solutions to the problems experienced before reaching our conclusions.

Rail passenger liberalisation in Britain

Over the period 1994-1997, almost all British rail passenger operations were divided into 25 companies, which were then offered as franchises to the most favourable bids. Minimum service levels were specified and some fares controlled, and bids invited in terms of the annual subsidy required (or premium offered) through what would normally be a 7-10 year franchise. The infrastructure was placed in a separate company, Railtrack, and privatised by sale of shares. Freight was also privatised by outright sale.

Within very few years, two crises hit the new structure. The first and most important was the placing of Railtrack into administration following an escalation of the costs of the major West Coast Main Line upgrade, and a massive increase in spending on maintenance and renewals generally following a fatal accident at Hatfield caused by a broken rail. But at the same time, the franchising process was in difficulties, with no fewer than five franchises close to bankruptcy having been unable to reduce costs to the extent foreseen. As a result, the infrastructure became the responsibility of a new not-for-dividend company, Network Rail, whose borrowings were guaranteed by the state, whilst a number of franchises were renegotiated or replaced with short-run management contracts, pending refranchising. As we shall see, during this period of disruption, costs of both infrastructure and train operations rose substantially, and ever since there has been a struggle to get them back under control.

Rail demand since privatisation

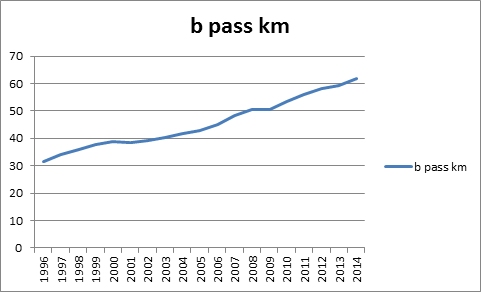

Figure 1 shows the remarkable performance of rail demand since franchising. An early ITS study found the increase in demand to be mainly due to external factors such as rising incomes, increasing road congestion and rises in the costs of motoring. Also, it was initially a franchise condition that regulated fares should increase at less than the rate of inflation, and train kilometres also rose as demand grew. However, part of the increase in traffic could not be explained by the model and might be attributed to improved marketing and customer service post privatisation. But the continued growth of rail demand through the economic crisis of 2008 remains remarkable and not fully understood. The total liberalisation of railway operations through franchising, and the very strong incentives to grow revenue resulting from the adoption of net cost contracts to a much greater extent than in other European countries, may have played a role.

|

Costs

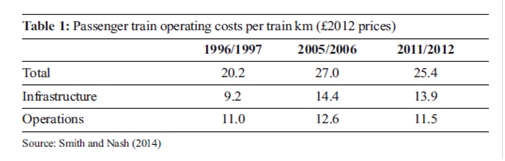

As aforementioned, the position regarding costs is a lot less favourable. Between 1996/1997 and 2005/2006, real cost per passenger train kilometre rose by some 35%, with the biggest increase being in infrastructure costs but also a significant increase in train operating costs. Since then, unit costs have been reduced, but in 2011/2012 it remained 25% higher than at the completion of franchising (see Table 1).

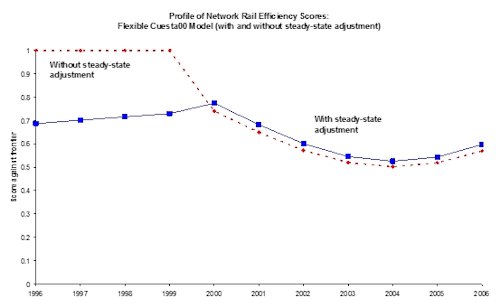

In the case of infrastructure, ITS was responsible for the benchmarking work initiated by the Office of Rail Regulation (ORR) to determine what level of cost reduction it should assume in its regulatory settlement. Figure 2 shows how Britain was performing relative to the efficiency frontier estimated based on a sample of other European countries at the time of the 2008 regulatory review of Network Rail’s finances. It is clear that the cost increase at the time of Hatfield led to Network Rail falling well below European best-practice, a decline from which it is only slowly recovering. Adjusting for the failure to maintain renewals at a steady state level considerably reduced the performance pre Hatfield but has little impact on the efficiency scores for later years. ORR set targets based on the efficiency gap of approximately 40% identified in Figure 2 and Network Rail has been steadily improving efficiency in line with those targets, though there is some way to go yet, as recent delays and cost overruns on major new projects shows.

|

What is more interesting is the situation regarding franchising. Studies by ITS have identified a number of reasons why franchising may have been less successful in Britain than in some other countries. Firstly, the placing of some franchises on management contracts clearly increased their costs, although costs returned to expected levels after refranchising. Secondly, we found that typically British franchises were inefficiently large – much larger than in countries such as Germany and Sweden – and also in some cases lost economies of density by splitting services on the same route between more than one operator - although such economies of density are limited when the services are diverse in their characteristics, such as the type of rolling stock needed to run them. Thirdly, we found that competition between train operators for scarce skilled staff, particularly drivers, had pushed up salaries in the industry much faster than in the economy as a whole. In most countries, winners of franchises had the opportunity to bring in their own staff, with different salaries and conditions to those of the incumbent; in Britain, the winner of a franchise took over an existing company and its staff. True, having taken over they could seek to implement changes in working practices and salary structures, but with relatively short franchises, it appears that the incentives to do this were inadequate. Another piece of work we undertook concluded that short franchises had led to a short-term view by franchisees when they took the lead in procuring rolling stock, reducing incentives for innovations to reduce life cycle costs.

The McNulty report in 2011 considered the way in which vertical separation between infrastructure manager and train operators had worked to be a major factor in the cost increase. Our work found some evidence that the transaction costs of negotiating, monitoring and enforcing contracts was a factor, although this would not amount to more than a few per cent increase in systems costs. More significantly, the EVES-rail study found evidence that complete vertical separation on densely used networks raised costs, and concluded that this was due to a lack of incentives for the infrastructure manager and train operators to work together to optimise system costs.

Possible solutions

The McNulty study concluded that longer franchises and joint ventures between the infrastructure manager and franchisees were important measures to improve efficiency. South West Trains formed the prototype for the latter, by implementing a structure in which the staff of the two bodies in the area concerned were merged under a common management, and changes in both costs and revenues shared. Of course, this will only overcome the problem of misalignment of incentives where almost all train services in the area in question are run by a single operator. Where, as in Britain, most services are passenger trains run under franchises that may be the case but will not be where freight accounts for a larger proportion of operations. But government seems to have reversed its initial acceptance of the case for longer franchises, whilst arguing reasonably that each case should be taken on its merits. An alternative approach to alignment of incentives is for services to be run under short contracts but with heavy intervention by the franchising authority on issues such as working practices and choice of rolling stock. That is essentially the approach taken in London to the London Overground franchise.

As noted in this article’s opening paragraphs, there is an alternative way of introducing competition into rail passenger services, and that is by implementing open access for new commercial operators to enter the market. A recent report from the British Competition and Markets Authority strongly advocates this approach. It does have the advantages of making competition a continuous process, rather than something occurring only when a new franchise is awarded, and encouraging innovations which may be ruled out by the conditions of the franchise. It allows new operators to come in with their own salary structures and working practices, though splitting up output between operators could result in loss of economies of density. The cost implications in any given situation are hard to forecast. But it also has very real disadvantages. It will make getting a well-planned integrated timetable on the route more difficult. The evidence on economies of density suggests that splitting similar operations on a single route between operators will, other things being equal, raise costs, whilst it will also rule out the sort of deep alliances with the infrastructure manager referred to above. At present, experience of open access competition in Britain is limited to niche markets by a decision that it should not be permitted where it is primarily abstracting revenue from the franchisee, and it will be to countries where it is more extensive – Italy, the Czech Republic and Sweden – that we need to look for experience.

Conclusions

The British experience of rail passenger liberalisation has been mixed. In terms of demand, the last 20 years have been a period of amazing success – although there is still a lack of clear evidence on the part franchising has played in this. It is with respect to costs that the results are disappointing.

A number of lessons arise from the British experience. Firstly, it is important to resume competitive tendering for contracts as soon as possible after failure of a franchise. Secondly, it is important to consider the appropriate size and configuration of franchises from the point of view of cost efficiency and risk of failure. Strong economic regulation is also important in terms of ensuring access and pressure for improved efficiency on infrastructure managers. But most importantly, it is necessary to consider carefully how to give appropriate incentives to all parties to work together to optimise long-term system costs. In British circumstances, this means either franchises in which many of the key decisions regarding working practices and investment are reserved for government bodies, or long franchises coupled with deep alliances between the franchisee and Network Rail. Whilst such alliances are increasingly coming into existence at refranchising, it is not clear that the 7-10 year franchises which are again the norm are long enough to give adequate incentives to tackle the need to improve working practices and to innovate in terms of rolling stock, and government has taken to intervening directly on these issues (for instance, procuring rolling stock itself and requiring one person operation). Regulation and contracts can only go so far in achieving the required alignment of incentives.

Acknowledgement

The authors are grateful to the International Transport Forum for permission to reproduce tables and figures from Smith and Nash (2014), and to colleagues Professor Mark Wardman and Dr Phill Wheat for their contribution to the research discussed in this paper.